What is a term life policy?

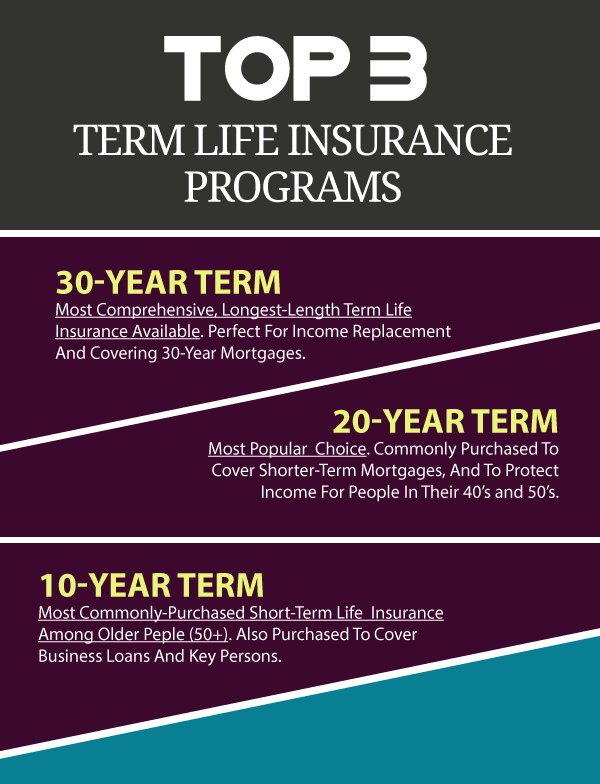

A term life policy provides an amount of money if you pass away during the policy term. The amount of money you receive is called the ‘death benefit’ and can run from as low as $50,000 to as high as $10,000,000! Additionally, you can have a policy for 10 to 40 years. This variability is what makes term life policies so great, they can be tailored to meet your exact needs. Are you 55 and wanting to cover your kids college funds if you pass way? Great, pick up a 10 year, $500,000 policy. Are you in your 30s and picking up a mortgage? In this case it makes sense to have a 20 or 30 term for $1 or $2 million.

How much do they cost?

The main determinant for the price of a term life policy depends on your health. The primary rating classes are standard, standard plus, preferred, and super preferred. Things like smoking habits, medication you take, height, weight, age, and physical activities you take part in will affect which class you qualify for. Ideally, you will be rated at super preferred to get the best rate, but this class will be solidified once you take your exam. Many companies require a physical exam be performed by a licensed physician before your policy is issued. Typically, term life policies run between $30-60 per month.

This all sounds complicated

At Thousand Oaks Insurance, we make it extremely easy for you to get a term life policy. We represent all of the best, top-rated life insurance companies like Prudential, Pacific Life, and Transamerica. We prepare the quotes for you, make it easy to adjust the terms to your liking, and are always available to help guide you through the process. You can get the process started here.