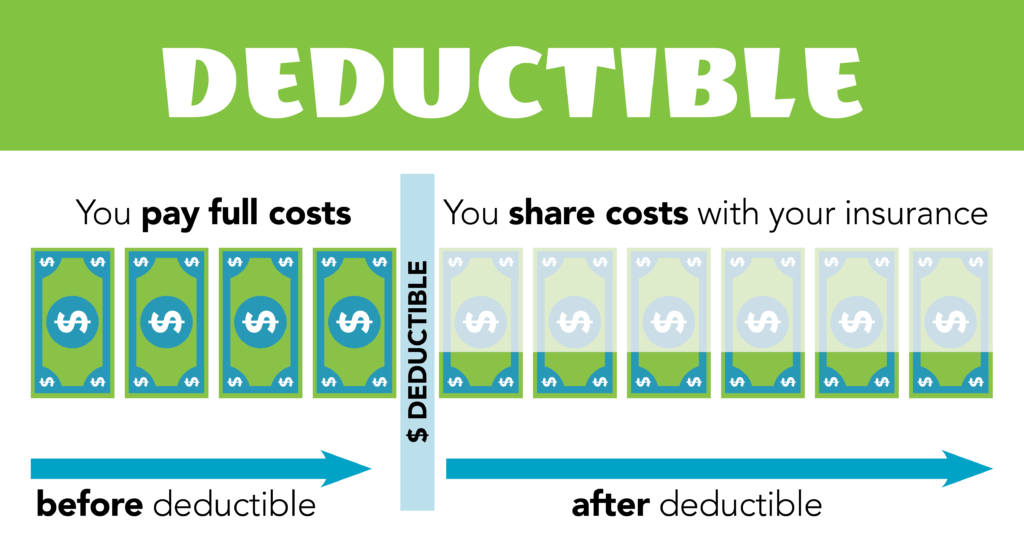

What is a deductible?

Deductibles are what you pay out of pocket before you insurance covers you. For example, let’s say you are in a car accident that causes $5,000 worth of damage to you car and you have a $500 collision deductible. You pay $500 out of pocket and your insurance covers the other $4,500.

Comprehensive and collision are the two most common coverages that include deductibles. Collision covers accidents with other cars typically. Comprehensive covers things like theft and weather related damage. Typically, things that are completely out of your control are comprehensive.

Which deductibles should I choose?

Deductible amounts typically range anywhere from $100 to $2,000. Most people go with $500, but it is up to you.

Higher deductible = Lower car insurance rate and higher out of pocket costs

Lower deductible = Higher car insurance rate and lower out of pocket costs

I recommend choosing a deductible that corresponds with the value of your car. If you drive a lemon that is worth $1,000 then it is probably not worth it to have a deductible at all. If you have a 2020 BMW then you may want to carry a $1,000 deductible.

When you don’t have to pay your deductibles

A deductible won’t apply to you in the following scenarios:

-

An insured driver hits you

If the other driver is officially deemed at fault, their insurance company can pay for your repairs if you choose, and you won’t have to pay your deductible. Or, if you have collision coverage, you can choose to go through your own insurer who will seek reimbursement (including your deductible) from the other driver’s insurance company. In situations where fault is shared, you may end up paying all or part of your deductible.

Keep in mind, if you’re hit by an uninsured or underinsured driver, a deductible may apply to your uninsured/underinsured motorist property damage coverage in certain states.

-

Another person files a claim against your liability coverage

There is no deductible on a liability claim. That means you pay nothing out of pocket for an accident claim in which your insurer pays for the damages and/or injuries you caused to another person, up to your policy’s limits.

-

You elected for no deductible

In some states, you’ll have the option to select a $0 deductible on your policy’s comprehensive coverage.

-

You have free repairs on glass claims

At Progressive, in most states, if we can repair (instead of replace) any glass breakage, you won’t have to pay your deductible.