How do insurance companies figure out your rate? It seems arbitrary at first glance. However, there are a multitude of factors that are considered when an insurance company determines what your rate is. I’ll go into each of these factors today. See below.

Driving Record

The single most important part of determining the premium you pay is your driving record. Do you have accidents and/or tickets? Not at-fault accidents do not affect your insurance rate. Unsurprisingly, at-fault accidents and moving violations (such as speeding tickets) increase your insurance rate. That being said, points drop off your record and stop affecting your insurance after 3 years typically.

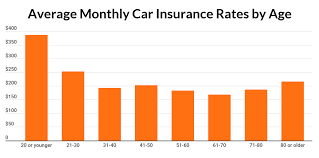

Age

How old are you? Driver’s who are 24 years old or younger are ‘youthful drivers’ and pay considerably more than anybody else. Typically, people between the ages of 25-60 see the lowest rates in regards to age. Your insurance premium will begin to rise as you grow older.

Type of Vehicle You Drive

Pop quiz! Which vehicle do you think is more expensive to insure? 2000 Honda Accord? Or 2021 Audi? Bingo! The Audi is by far the more expensive vehicle.

Additionally, the more vehicles you have, the higher your rate will be. There is a multi-car discount if you have 2 or more vehicles on your auto policy.

Coverage

Typically, higher coverage means a higher premium. I view higher coverage as an investment more than an expense. Higher coverage can save you money in the event of a claim.

Discounts

There are many discounts you can take advantage of to prevent your auto rate from getting out of control. First, the multi-policy discount applies if you bundle a home and auto policy with the same company. This saves up to 20% on both policies and is typically the most impactful.

Second, certain occupations, like teachers, engineers, and scientist, qualify you for substantial group discounts with certain companies.

Third, you will receive a small discount if you and your spouse are married and on a policy together.

Like I said before, there is a multi-car discount if you have 2 or more vehicles on the same policy.